When can I issue an invoice if I apply for registration after the invoice system starts?

The invoice system will start in a month.

I often hear announcements about the beginning of the invoice system on the radio that I usually play in the background.

In September, I have begun to receive inquiries regarding invoice registration, and I feel that it is finally starting.

This time, I will write about when invoices can be issued if you apply for registration after the invoice system starts.

Specify a day after the 15th from the application submission date

After completing the consumption tax payment simulation and deciding to register the invoice, when will it be able to issue invoices?

In order to issue an invoice, it is essential to get the registration number, which is written in an invoice.

To get your registration number,

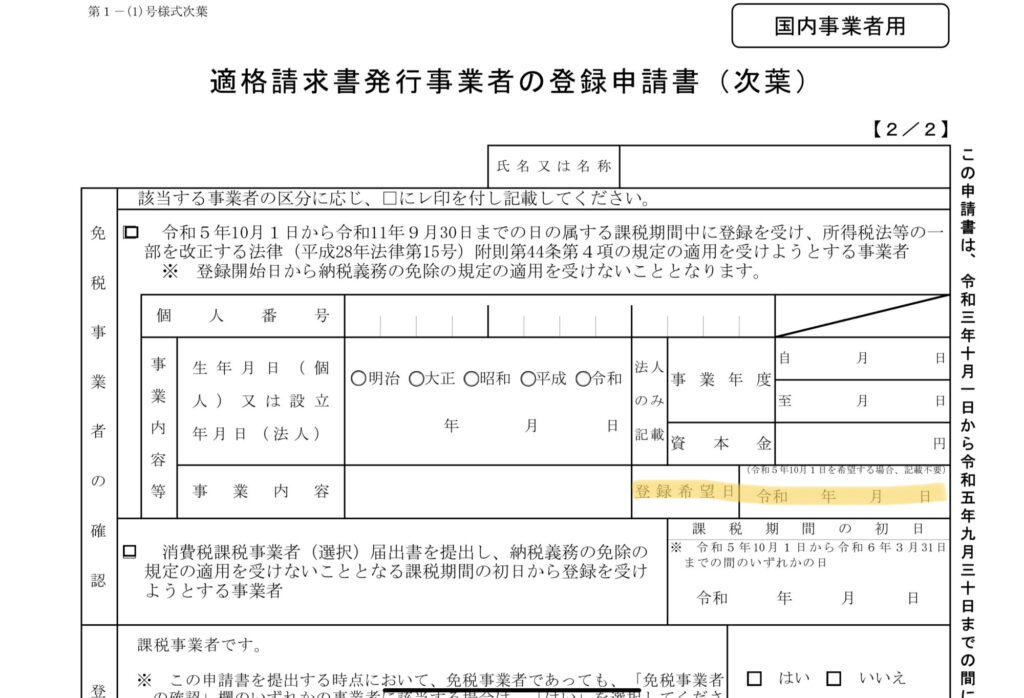

You have to submit “Application form for registration of qualified invoice issuing business” to the tax office.

(Use this form if you are a foreign business operator)

On the second page of the application form, there is a column for "Registration desired date", so enter the start date for issuing invoices here.

Please note that the desired registration date must be 15 days or later from the date of submission of the application form.

Even if the completion date of registration at the tax office is after the desired registration date stated in the application form, it will be deemed that the registration was completed on the desired registration date.

In addition, in the case of a corporation, simply add a "T" to the beginning of the existing corporate number, so you can know the registration number without waiting for registration to be completed.

(However, invoices can only be issued after the desired registration date.)

In conclusion

This time, I have written about when invoices can be issued if you apply for registration after the invoice system starts.

After registering an invoice, you must deal with the invoice from the standpoint of the seller or buyer.

It is difficult to try to understand everything at once, so it is necessary to prioritize and respond to each issue one by one.

(I recommend that using the the 20% special exemption system or simplified taxation system will help you simplify caliculation of consumption tax payment amount.

-----------------------------------------------------------

都築太郎税理士事務所/Tsuzuki Taro Tax Accountant Office

ホームページ(Home)

プロフィール(Profile)

ブログ(Blog)

個人の方(料金表)(Individual-fee)

法人の方(料金表)(Corporate-fee)

お問い合わせ(Contact)