Important points to note regarding the application of the housing loan deduction if you plan to move in during 2025

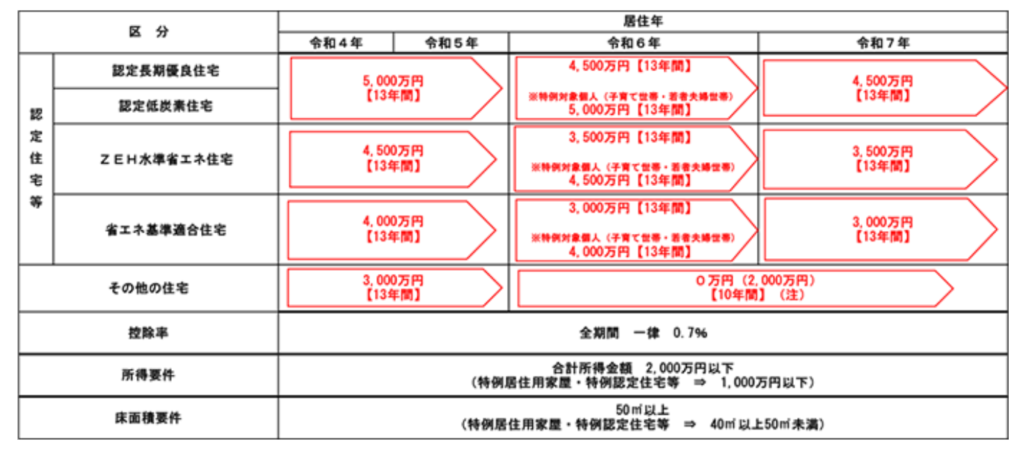

There have been changes to the housing that is eligible for the housing loan deduction starting from 2024.

We will look at what changes will apply if you plan to move in during 2025.

In principle, ordinary residences are not eligible

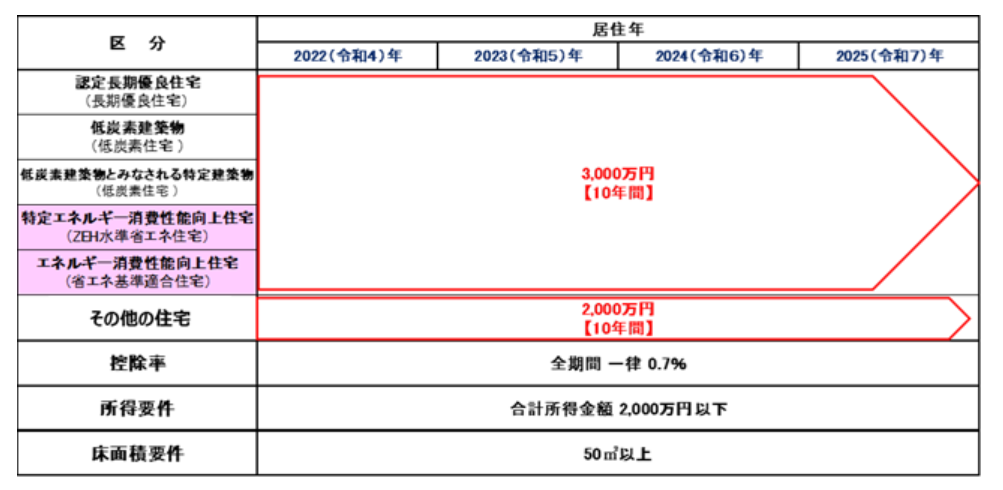

Previously, the housing loan deduction was applicable to ordinary houses other than long-lasting houses and houses that do not meet eco-friendly or energy-saving standards.

(Until occupancy in 2023)

However, as a general rule, ordinary houses will no longer be eligible for the housing loan deduction from 2024.

However,

- those that received building confirmation by December 31, 2023

- those constructed by June 30, 2024

In above case, the home loan deduction (deduction rate 0.7%) can be applicable for 10 years with a maximum loan amount of 20 million yen.

Since it is likely that there might be almost no homes that meet the above two requirements in 2025, care should be taken when deciding whether to apply.

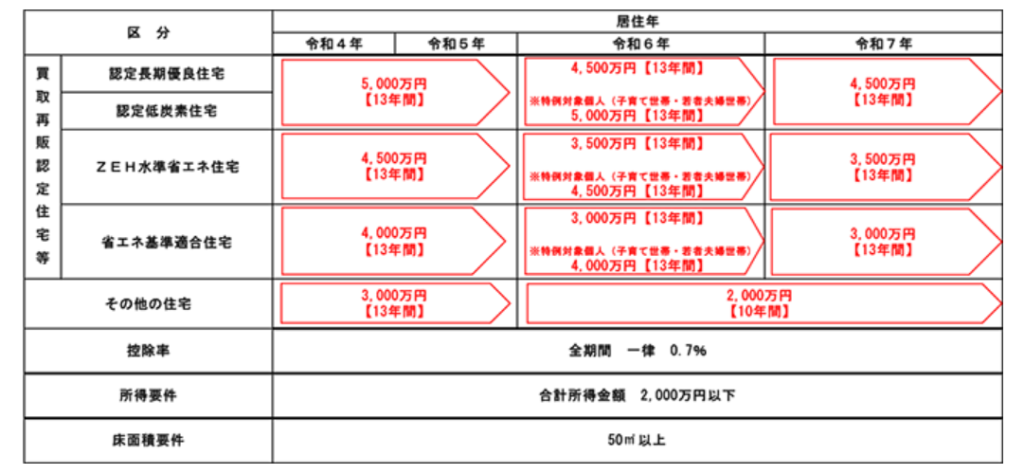

Used homes remain the same in 2025

For used homes that meet certain requirements, the housing loan deduction is also applicable to regular homes.

Used homes that meet certain requirements are called homes for resale.

For homes for resale,

- Home loan deductions are available for regular homes,

- For homes that last a long time and meet eco-friendly and energy-saving standards, you can receive the same deductions as for new homes in terms of both deduction limits and years.

Conclusion

This time, I explained the points to note about applying for the housing loan deduction if you plan to move in by 2025.

It is essential to always keep up with tax reforms.

-----------------------------------------------------------

都築太郎税理士事務所/Tsuzuki Taro Tax Accountant Office

ホームページ(Home)

プロフィール(Profile)

ブログ(Blog)

個人の方(料金表)(Individual-fee)

法人の方(料金表)(Corporate-fee)

お問い合わせ(Contact)