The reason 10% of the tax rate is not used to calculate consumption tax returns

It is widely known that the consumption tax rate is 10% (reduced rate of 8%).

If you carefully look at the numbers on your consumption tax return, you may notice that the consumption tax amount listed is less than 10%.

Why is it less than 10%?

Because the national tax portion is calculated first

The consumption tax rate is 10% (reduced rate 8%).

However, what is not widely known is that this 10% is the sum of 7.8% national tax (reduced rate 6.24%) and 2.2% local tax (reduced rate 1.76%).

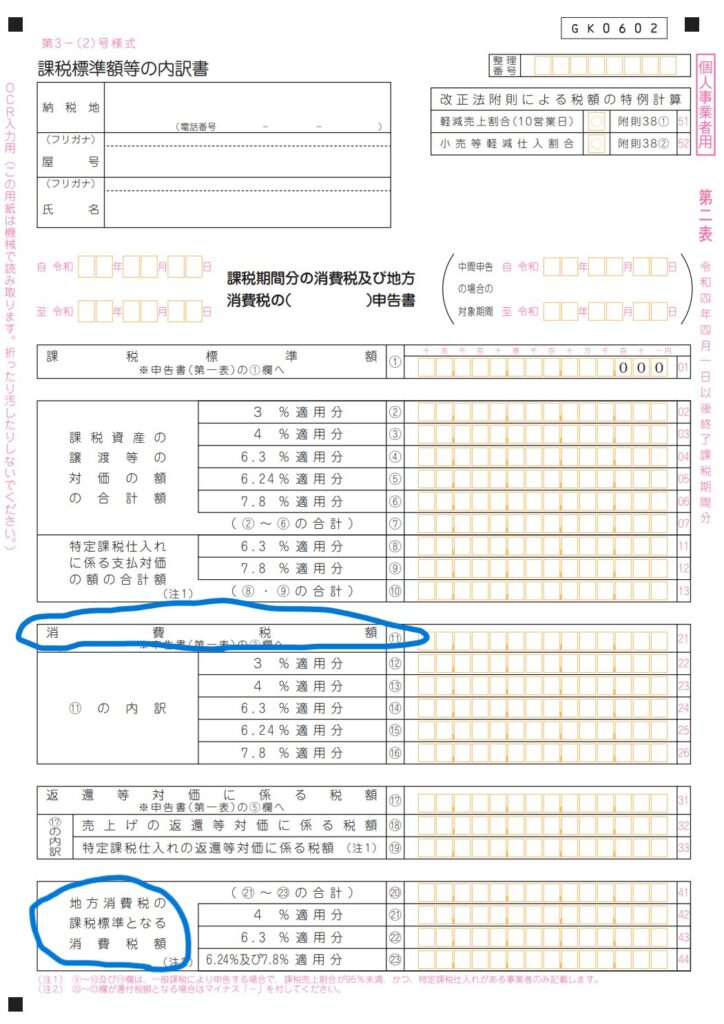

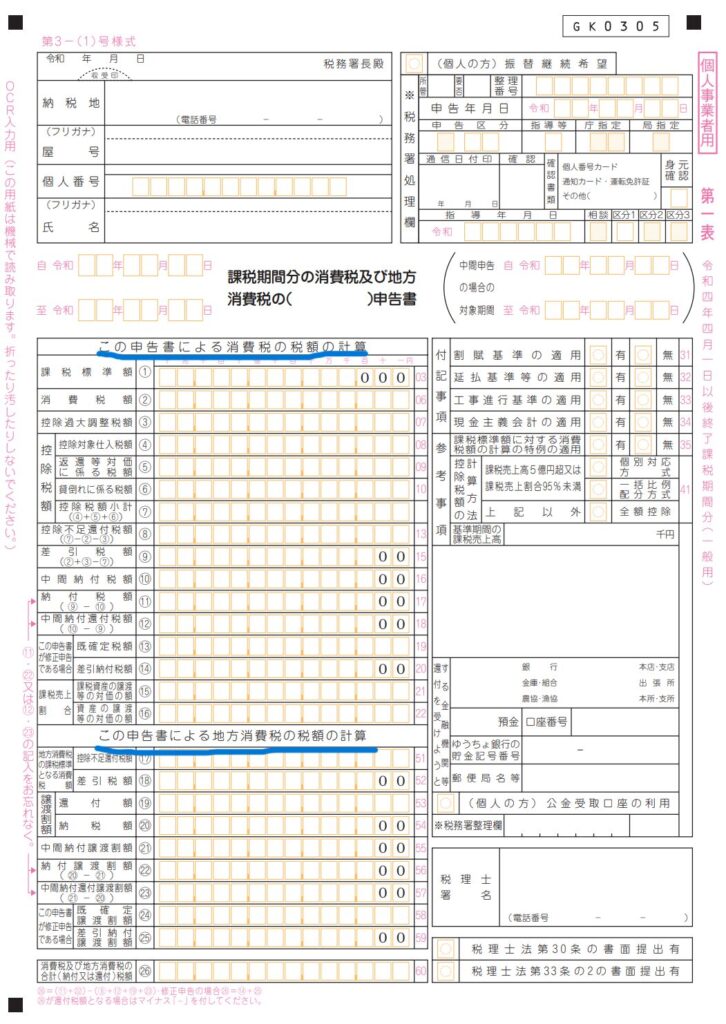

If you take a look at the consumption tax return form (sheet 2), you will see that it is divided into national tax and local tax.

The tax rates are not only 7.8%, 6.24%, but also range from 3% to 7.8%.

(These are the results of the consumption tax rate changing from 3% to 5% to 8% to 10% (or an 8% reduction) respectively.)

When filing the consumption tax return (sheet 1), the amount of national tax to be paid is calculated first, and then the amount of local tax to be paid is calculated from the amount of national tax to be paid.

Therefore, tax rates such as 10% and 8% are not used in the calculation process.

Finally, enter the total amount of national and local taxes paid in the bottom column; this is the amount to be paid.

Editor's Note

In this article, I have explained why the tax rate used to calculate consumption tax returns is not 10%.

You might think that consumption tax is simple because it is either 10% or a reduced rate of 8%, but the system for calculating the amount to be paid is actually quite complicated.

-----------------------------------------------------------

都築太郎税理士事務所/Tsuzuki Taro Tax Accountant Office

ホームページ(Home)

プロフィール(Profile)

ブログ(Blog)

個人の方(料金表)(Individual-fee)

法人の方(料金表)(Corporate-fee)

お問い合わせ(Contact)