What is a simplified dependent deduction declaration form?

A dependent deduction declaration form must be submitted when receiving a salary.

Previously, we had to fill out the form every year, even if the information about dependents was the same as the previous year.

However, starting from January 2025, we could be permitted to submit a simplified dependent deduction declaration form for salary payments received after that.

What is a simplified dependent deduction declaration form?

The simplified dependent deduction declaration form is OK if there are no changes to the information about dependents from the previous year.

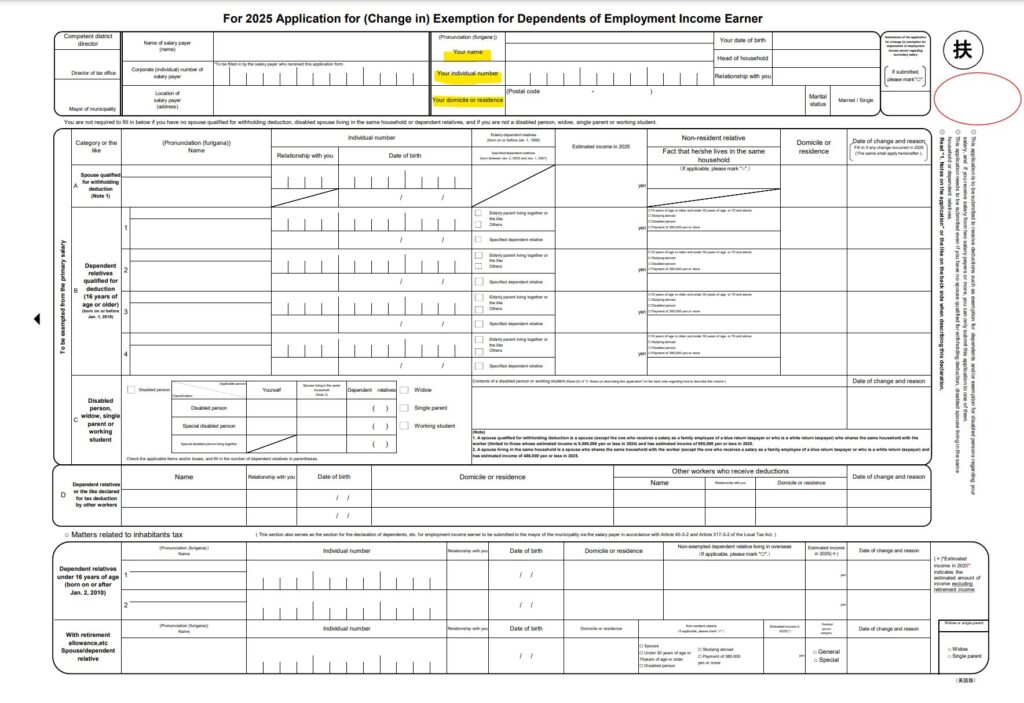

Specific information to be filled in is

- Name

- Address

- My Number (can be omitted under certain conditions)

- In the right margin, write "No changes from the previous year

For 2025 Application for (Change in ) Exemption for Dependents of Employment Income Eaner-National Tax Agency HP

What is the extent of no changes from the previous year?

When determining whether a spouse is eligible for the withholding deduction or whether a dependent is eligible for the deduction,

- Estimated income

- Increase or decrease in the deduction amount due to age

must be considered annually.

To what extent should there be no change?

Let's look at each of these.

Estimated income

The amount of income required to be considered a dependent.

It is not the same every year.

Looking at it from a detailed perspective,

some people may think that because the estimated income has changed from the previous year,

it is not possible to submit a simplified tax return.

However, if the estimated income is within the range of the deduction, it is possible to submit a simplified tax return.

(950,000 yen or less for a spouse eligible for the withholding deduction, and 480,000 yen or less for a dependent eligible for the deduction)

Increase or decrease in deduction amount depending on age

Even if we are within the range of income eligible for deductions, the amount of the dependent deduction would vary depending on our age.

For example,

・When we turn 70 (elderly dependent)

・When we turn 19 (special dependent)

・When we turn 23 (dependent eligible for deduction)

・When we turn 16 (dependent eligible for deduction)

The amount of the deduction would increase or decrease.

In this case, we cannot submit a simplified tax return.

Since there has been a change in the information we have entered, we need to fill out a tax return using the traditional method.

Editor's Note

This time we provided a brief explanation of the simple dependent deduction declaration form.

New systems for year-end tax adjustments are being introduced one after another.

It is essential to keep up with the changes.

-----------------------------------------------------------

都築太郎税理士事務所/Tsuzuki Taro Tax Accountant Office

ホームページ(Home)

プロフィール(Profile)

ブログ(Blog)

個人の方(料金表)(Individual-fee)

法人の方(料金表)(Corporate-fee)

お問い合わせ(Contact)